Onar Alili

Engineer

3 minutes to read

What are Overpayment scams, and how to protect yourself?

Overpayment scam is a common fraud for online businesses. We have seen many web agencies targeted with this type of fraud. There are a few variation of overpayment scams. While they all work in a similar fashion, in general, Overpayment scams work by asking you refund a scammer who sent you an extra money for your services.

How Overpayment Scam works?

The scammer may pay you through cheque, international money transfer services like WesterUnion or with a stolen credit cards. Once you name your price for your service, they will pay full amount with generous “tip” on top. They will try to explain why they made an extra payment. No matter what is the reason, they will ask you to refund the extra amount. After you pay back, they will disappear, and you will never get your money. Their original payment was made through stolen credit card, or bank rejected (bounced) their cheque. As you already sent them money, it’s too late to get your money back.

Be especially careful with variations, for example this web agency is targeted by the same scam. However, this time the scammer asks you to refund a third-party consulating company which doesn’t exists. The refunded payment to the consulting company goes to the scammer. The fraudster original pay disputed by the actual card owner.

In another version of this fraud, they may sent you a fake Paypal invoice and claim the payment is being held until you refund the extra.

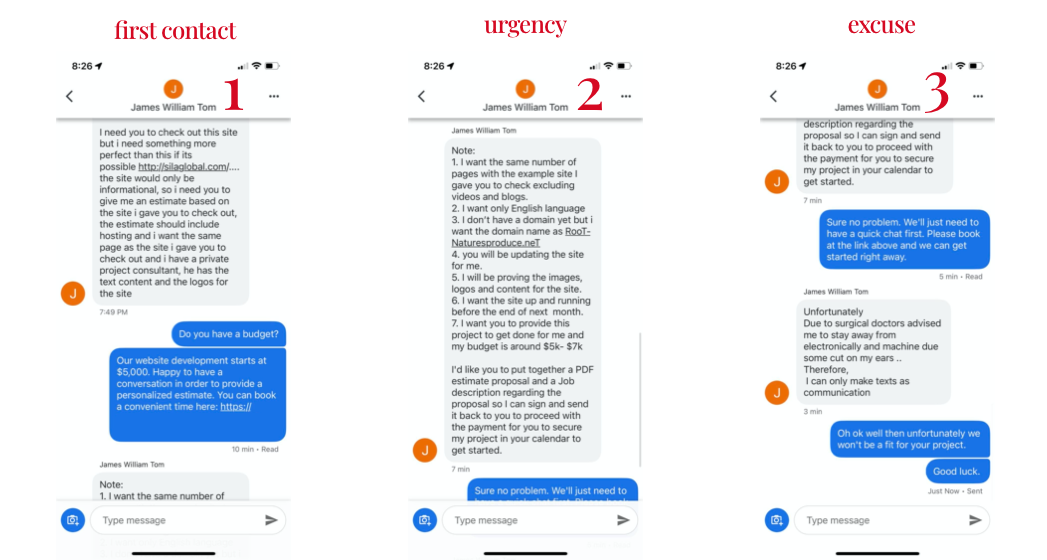

You may get contacted through different channels including through your contact forms, Google Business Messages (aka GBM) or email. Regardless of the contact method, it’s important to be aware of this scam and how to see the red flags.

How to protect yourself from Overpayment Scams

-

If a cheque amount is higher than what you agreed upon. Ask for a new cheque.

-

Don’t send any item, do any work until you see the amount in your account.

-

If you’re providing a service, ask them to have a call to talk about details. Be careful, some of them agree to have audio call but many of them will refuse and give a fake excuse.

-

If a scammer or legitimate customer pays you through a credit card, only agree to refund back to the same card.

-

Don’t send money to third-party companies or anyone on behalf of your customer. This is considered money laundering.

-

Did I say, don’t do any work until you see the agreed amount in your account?

It’s a good practice to meet your clients over a video call and document/log every conversation. Use payment method you are familiar with and keep eye on above red flags.